Table of Contents

[ Show/Hide ]- • FBS Review: What You Need to Know Before Opening an Account

- • Is FBS a Regulated Broker and Safe?

- • FBS Account Types and FBS Rebates

- • FBS Trading Platforms

- • FBS Instruments

- • FBS Fees, Spreads, and Commissions

- • FBS Trading Tools

- • Market Analytics, Insights, and Education at FBS

- • FBS Deposits and Withdrawals

- • FBS Customer Support

- • How to Get FBS Rebates with HighFxRebates

- • FBS Pros and Cons

- • Conclusion – Should You Trade with FBS?

- • FAQs

FBS Review: What You Need to Know Before Opening an Account

Updated: December 2025

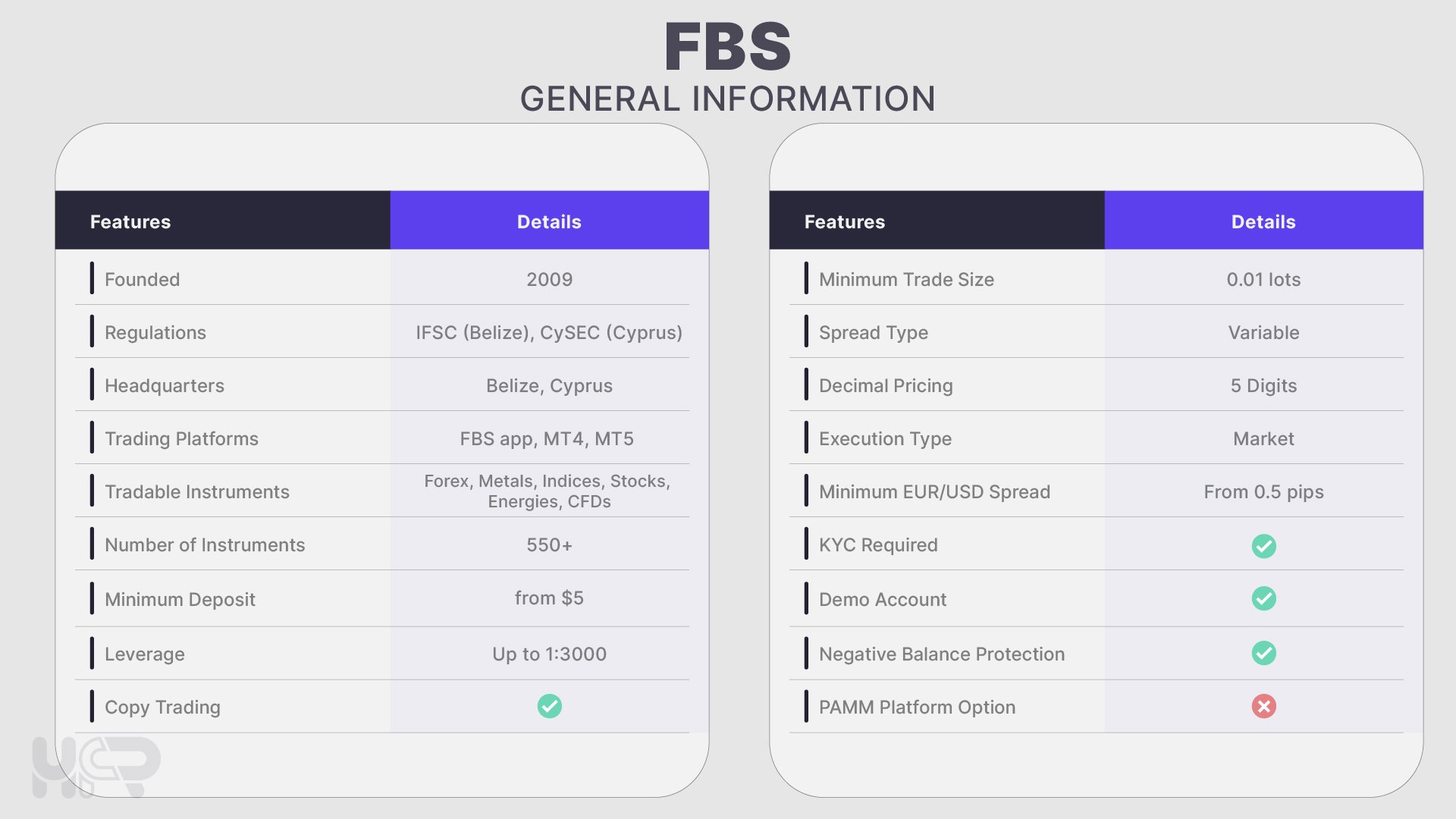

Founded in 2009, FBS is an established multi-asset forex and CFD broker serving traders in more than 150 countries. The company provides access to forex, metals, indices, energies, stocks, and cryptocurrencies, offering multiple trading environments for both beginners and experienced users.

FBS broker supports several platforms- MetaTrader 4, MetaTrader 5, and its own FBS Trader App- allowing clients to trade across devices with full market functionality. The broker has also developed tools for copy trading and risk management, helping traders automate or mirror strategies with minimal setup.

If you’re comparing functionality across different providers, you can check FBS alongside others using our full broker comparison tool.

When it comes to FBS regulation and safety, the broker operates through several licensed entities, including CySEC in the EU, FSCA in South Africa, and FSC Belize for international clients. Each entity applies its own rules for client fund segregation, encryption standards, and negative balance protection. For traders asking, “Is FBS safe?”, the broker’s multi-jurisdiction structure provides a solid level of oversight for retail trading.

In partnership with HighFxRebates, traders can earn up to 27% spread rebates on every trade, paid weekly. This FBS Rebates does not alter spreads, leverage, or execution; it’s simply a rebate on the broker’s existing trading costs—the full details on FBS rebates.

Overall, FBS offers a wide product range, established regulation, and flexible FBS trading conditions suitable for most retail traders looking for both short-term and long-term strategies.

Is FBS a Regulated Broker and Safe?

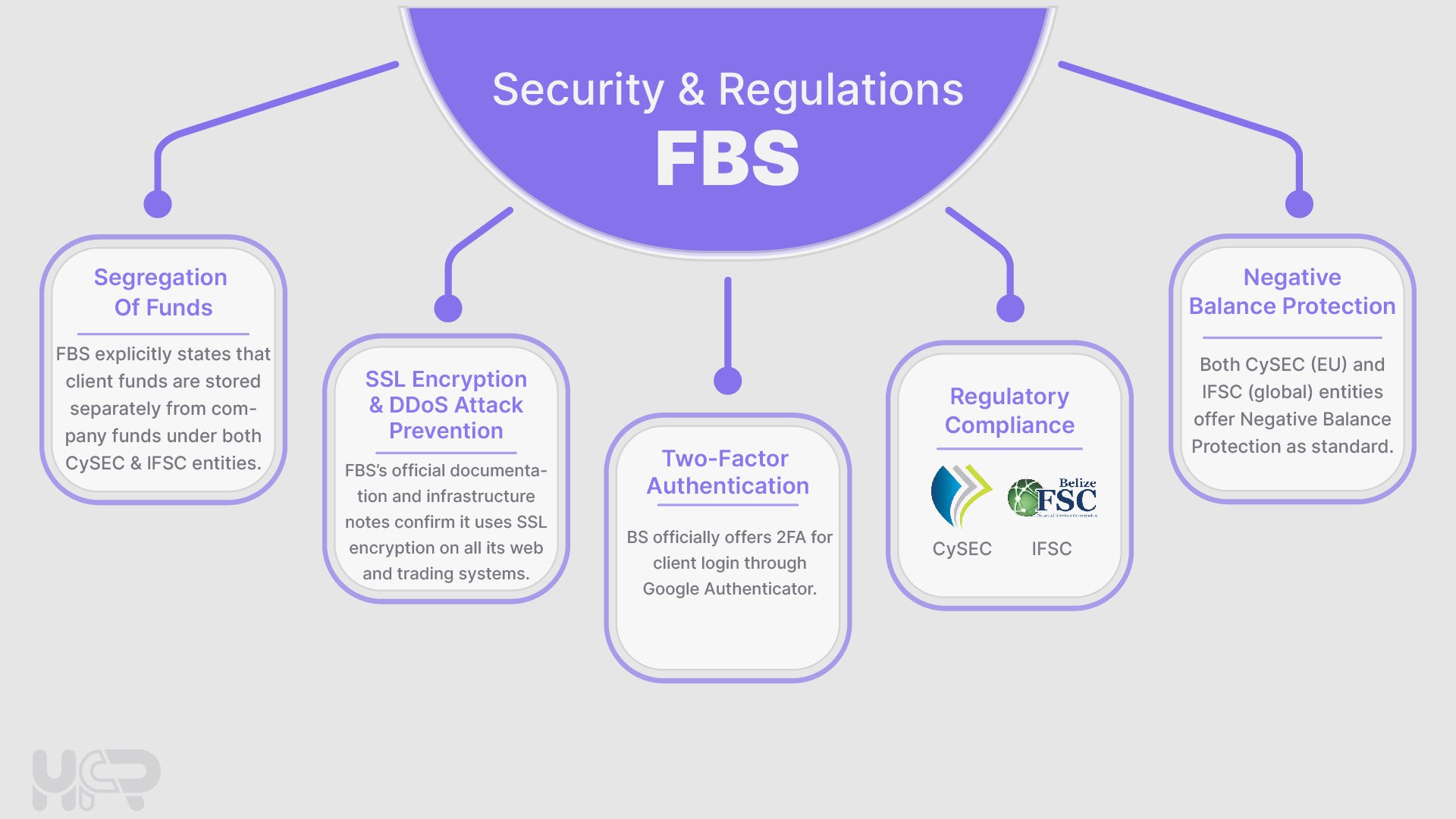

FBS operates as a multi-jurisdictional broker, meaning it is regulated under different authorities depending on where a trader registers. This structure allows FBS to comply with regional rules while maintaining global accessibility.

For European clients, FBS is regulated by the Cyprus Securities and Exchange Commission (CySEC) under Tradestone Ltd - a license that ensures strict adherence to EU financial standards, including MiFID II compliance, client fund segregation, and investor compensation coverage.

Outside the EU, FBS operates under FBS Markets Inc., authorized by the International Financial Services Commission (IFSC) of Belize, and FBS South Africa (PTY) Ltd, licensed by the Financial Sector Conduct Authority (FSCA). These entities allow FBS to serve international traders with more flexible leverage options and localized payment methods.

The broker’s safety measures include:

- Segregated client funds held in top-tier banks.

- Negative Balance Protection ensures clients cannot lose more than their deposits.

- SSL encryption across platforms and personal areas for data protection.

- Two-factor authentication (2FA) on client accounts for additional security.

Although FBS is not a bank and client funds are not covered by deposit insurance, its regulatory setup and long operational history add a reasonable degree of trust. As always, traders should choose the FBS entity that matches their region and regulatory preference.

FBS Account Types and FBS Rebates

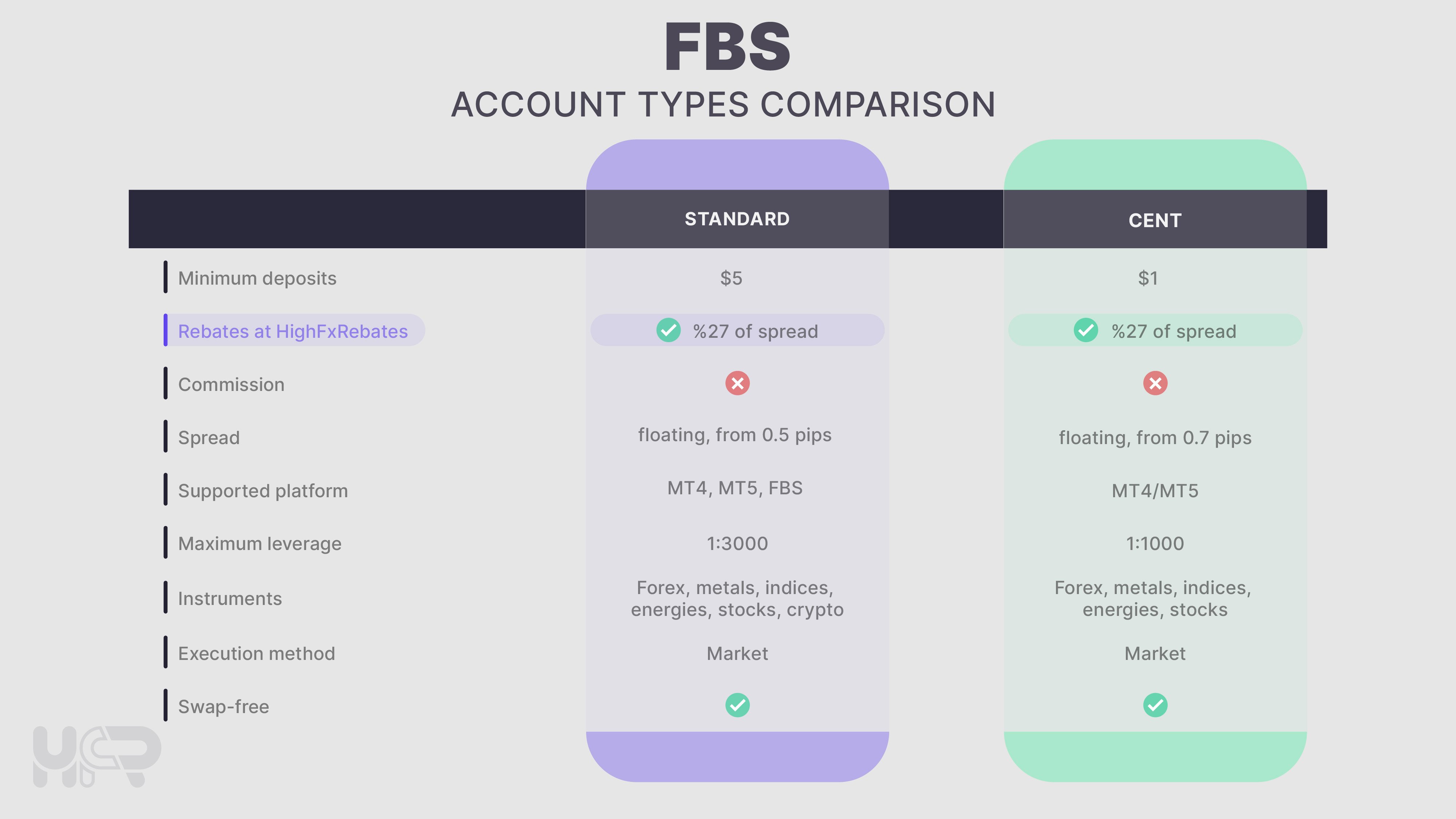

At FBS, traders can currently choose between two live account types — Standard and Cent — plus a Demo Account for practice. This simplified structure keeps things clear for traders of all experience levels and regions.

The Standard Account offers balanced trading conditions that suit both beginners and experienced traders.

Spreads typically start from 0.5 pips, leverage can reach 1:3000 (outside the EU), and there are no commission fees.

It’s ideal if you prefer straightforward spread-only pricing and access to the full range of instruments, including forex, metals, indices, and energies.

When you trade the Standard Account via HighFxRebates, you can earn up to 27% of the spread back as weekly rebates to your HFR account. Check the FBS cashback offer.

- Cent Account

The Cent Account is built for low-risk trading with micro-lot sizes. It’s perfect for testing new strategies or EAs without exposing a full-size balance.

Spreads start slightly higher than Standard but are still competitive, and you can open positions as small as 0.01 lot. Because this account mirrors live market conditions, it’s also an excellent step between a Demo Account and real Standard trading.

FBS pays rebates on Cent trades as well; you’ll receive 27% of the spread, calculated proportionally to the smaller contract size, through HighFxRebates.

- Demo Account

For anyone still learning the platform, Demo Accounts allow you to practice on MT4, MT5, or the FBS Trader app with virtual funds.

They’re free, unlimited in duration, and help you understand order types, risk control, and margin before switching to a live Standard or Cent account. FBS’s simplified lineup keeps trading accessible without hidden tiers or confusing upgrades.

If you’re still deciding how to choose the right broker, check our guide: What Is a Broker and How to Choose One.

FBS Trading Platforms

FBS supports three main platforms: MetaTrader 4, MetaTrader 5, and the proprietary FBS Trader App. Each provides a different balance between charting tools, automation, and mobility, letting traders choose how they interact with the market.

- MetaTrader 4 (MT4): It offers a familiar interface, fast execution, and wide compatibility with Expert Advisors (EAs) for automated strategies. Its focus on simplicity makes it ideal for day trading, manual setups, and backtesting basic algorithms.

- MetaTrader 5 (MT5): more order types, deeper market depth (DOM), and an integrated economic calendar. It’s often preferred by traders who manage multiple instruments or rely on more advanced analytical tools.

- FBS Trader App: For those who prefer mobile-first trading, the FBS Trader App offers an all-in-one experience with built-in account management, deposits, withdrawals, and price alerts. It connects seamlessly to live accounts, enabling quick execution even when away from the desk. The app also includes simplified charting for beginners and multi-chart monitoring for more experienced users.

To understand how rebates interact with platform-based costs, you can refer to this article: Why Rebates Matter for Traders?

FBS Instruments

FBS offers a solid mix of forex and CFD instruments, giving traders room to diversify. You can trade 40+ currency pairs, metals like gold and silver, energies such as Brent and WTI, major global indices, and a selection of US and EU stock CFDs. FBS also provides crypto CFDs on Bitcoin, Ethereum, and other popular coins without needing an external wallet.

Explore the Crypto Exchange Cashback Guide if you trade digital assets on exchanges such as Bybit or Binance.

FBS Fees, Spreads, and Commissions

FBS keeps its pricing simple. Both Standard and Cent Accounts use a spread-only model, meaning there are no hidden commissions on live accounts. On major forex pairs, Standard account spreads usually start around 0.5–0.8 pips, offering a straightforward setup for everyday trading. The Cent Account follows the same structure but applies micro-lot sizing, so total costs remain proportionally smaller.

FBS does not charge deposit fees on most methods, and withdrawal costs depend on your payment provider. Overall, funding and payouts remain fast and predictable.

When you trade via HighFxRebates, part of your spread cost is returned to you as cashback, up to 27% of the spread. FBS rebates are credited weekly to your HFR account, reducing your average cost per trade and improving your long-term profitability.

In short, FBS keeps trading affordable and transparent, and when combined with HFR’s weekly cashback, it stands among the most cost-efficient brokers in its class.

New to cashback? Here’s how forex rebates work.

FBS Trading Tools

FBS provides traders with a set of practical tools to support daily decision-making and automate strategies efficiently. These tools are free to use for all verified clients and integrate smoothly with MT4, MT5, and the FBS Trader app.

Economic Calendar

The Economic Calendar on FBS keeps traders updated on key global events — interest-rate decisions, inflation releases, and GDP data.

Each event includes expected volatility and previous results, allowing traders to prepare their entries and avoid unnecessary exposure.

Trading Calculators

FBS offers a variety of Trading Calculators, including pip, margin, and profit calculators, that make it easier to estimate risk and plan positions before placing an order.

These are especially useful for traders who manage multiple pairs or want to control leverage precisely.

VPS Hosting

Active traders and algorithmic systems can benefit from VPS hosting, available directly through FBS. It allows Expert Advisors (EAs) to run continuously with minimal latency — even if your computer is turned off — ensuring more stable execution for automated strategies.

Islamic (Swap-Free) Accounts

For traders following Sharia principles, FBS provides an Islamic or Swap-Free Account option. This replaces overnight swap charges with a fixed administrative fee, allowing long-term trading without interest payments.

Market Analytics, Insights, and Education at FBS

FBS offers a solid mix of market analytics and education, making the broker useful for both beginners and active traders. The analytics hub includes three parts: Market Analytics, VIP Analytics, and Top Trades of the Hour. Daily updates cover forex pairs, commodities, and indices with simple charts and key levels. VIP Analytics goes deeper with sentiment and short-term forecasts, while Top Trades of the Hour highlights instruments most actively traded by FBS clients. All of this can be followed directly inside the FBS Trader App.

Education is another strong area in this FBS review. The FBS Academy provides structured lessons, videos, and beginner-friendly guides. The Trader’s Blog adds bite-sized articles on strategy, psychology, and market behavior, and the Glossary helps simplify complex forex terminology.

FBS Deposits and Withdrawals

FBS provides a straightforward and transparent funding process, supporting a wide range of payment options that cater to traders worldwide. Both deposits and withdrawals can be managed directly through the FBS Personal Area on desktop or inside the FBS Trader app, giving traders full control over their balance in just a few clicks.

Deposit Methods

You can fund your account instantly using bank cards, e-wallets (like Skrill or Neteller), and local payment systems, depending on your region.

Most deposits are free of charge, and funds typically appear in your trading account within minutes.

FBS does not charge any internal deposit fees, although your payment provider may apply small third-party charges.

Withdrawals

Withdrawals are processed via the same method used for deposits, following international AML guidelines.

Processing times usually range from 15 minutes to 48 hours, depending on the payment channel and verification status. FBS maintains a fast and reliable payout system, with clear details on each option visible in the client area before confirming a withdrawal.

Security and Compliance

All transactions are handled using SSL encryption and comply with regulatory AML/KYC standards under FBS’s operating entities. This ensures that your funds and personal information remain secure throughout every stage of the transfer.

When trading through HighFxRebates, all rebate payouts are added weekly to your HFR account, so you don’t have to withdraw them separately. That means your FBS cashback becomes part of your available balance, ready to trade or withdraw at any time.

FBS Customer Support

FBS provides responsive, multilingual customer support, making it easy for traders worldwide to get assistance when needed. Support is available 24/5 through live chat, email, and in-app messaging via the FBS Trader App, helping clients resolve issues quickly from account verification to platform setup.

Support Channels:

- Live Chat: Fastest option, usually replies in under a minute.

- Email: Regional teams handle account-specific questions at [email protected].

- Help Center: A detailed library covering accounts, platforms, bonuses, and funding.

FBS supports dozens of languages — including English, Spanish, Arabic, Thai, and Indonesian- ensuring culturally aligned and timely responses.

If you need help linking your FBS account to HighFxRebates or checking rebate eligibility, our HFR Support Team is also available to assist. Together, FBS and HFR offer a reliable, transparent support system so you can trade with confidence.

How to Get FBS Rebates with HighFxRebates

Getting FBS rebates is quick and straightforward. When you connect your account through HighFxRebates, you can earn up to 27% of the spread back every week without changing your trading conditions.

Steps to Activate Your Rebates

1. Create your HFR account: Register on HighFxRebates and access your dashboard.

2. Open an FBS account via our partner link: Choose Standard or Cent, select MT4, MT5, or the FBS Trader App, and complete registration.

3. Add your FBS account to HFR: In your dashboard, go to Forex Accounts and submit your FBS trading account number.

4. Wait for approval: The HFR team verifies your account (usually within 1–2 business days).

5. Trade and earn weekly cashback: Rebates are paid automatically each week to your HFR account balance.

Start earning the Highest FBS cashback today by opening your FBS account through HighFxRebates.

FBS Pros and Cons

Every broker comes with strengths and trade-offs, and FBS is no different. Here’s a streamlined look at what stands out in this FBS review and where the broker may feel limited, depending on your trading style.

✅ Pros

- Regulated under CySEC, FSCA, and IFSC, giving FBS a solid, multi-jurisdictional safety framework.

- Simple account lineup — Standard and Cent — easy for beginners and everyday traders to understand.

- High leverage (up to 1:3000) for international clients who want flexible position sizing.

- Tight spreads from 0.5 pips and no hidden commissions on Standard and Cent accounts.

- Strong educational ecosystem through FBS Academy, Trader’s Blog, and the built-in glossary.

- Excellent mobile trading experience with the FBS Trader App.

- Fast and convenient deposits/withdrawals via regional payment methods.

- Fully compatible with HighFxRebates, allowing traders to earn up to 27% cashback weekly without changing spreads or leverage.

⚠️ Cons

- Only two account types in most regions (Standard and Cent), with no ECN or Pro options.

- Leverage and promotions vary depending on the regulatory entity.

- Inactivity fees may apply after long periods without trading.

- No guaranteed stop-loss (GSLO) feature for additional risk protection.

- Market analysis is helpful but less advanced than premium multi-asset brokers.

For comparison, you can also read our detailed XM review to see how both brokers differ in spreads, bonuses, and rebate levels.

Conclusion – Should You Trade with FBS?

FBS has built a strong reputation as a globally recognized forex and CFD broker, offering a clean, beginner-friendly setup backed by transparency and solid support. With only two core account types — Standard and Cent — traders can start small, test strategies, and grow at their own pace without being overwhelmed with complex tiers.

The combination of MT4, MT5, and the FBS Trader App, fast execution, multilingual support, and a solid educational ecosystem makes FBS a practical choice for most retail traders. While it doesn’t offer ECN-style accounts, its micro-lot flexibility and straightforward conditions make it particularly attractive for new and intermediate traders.

For traders who prefer checking external evaluations, FBS also holds an independent rating on WikiFX, which you can review to see how third-party sources assess the broker.

Is FBS Worth It in 2025? Yes, especially for traders who want strong leverage, multiple account types, and reliable weekly cashback through HighFxRebates. If you want low costs and flexible trading conditions, FBS remains a solid choice.

👉 Get Your FBS Rebates Up to 27% — Join HFR Today!

Disclaimer

Trading forex and CFDs involves significant risk and may not be suitable for all investors. Always trade responsibly and never risk money you cannot afford to lose. Rebate values depend on account type, region, and broker confirmation.

FAQs

1. Is FBS a safe broker?

Yes. FBS is regulated by CySEC, FSCA, and IFSC, uses segregated client funds, and protects accounts with SSL security. For more on choosing safe brokers, read our guide How to Choose a Forex Broker?.

2. What account types does FBS offer?

FBS provides Standard, Cent, and a Demo Account. Both live accounts use spread-only pricing with no commission.

3. How much can I earn in rebates with FBS?

When you trade through HighFxRebates, up to 27% of the spread is returned weekly as cashback. Your spreads, leverage, and execution stay the same.

4. How do I link an existing FBS account to HighFxRebates?

Contact FBS Support and request a transfer to the HighFxRebates IB code 7521598. Then log in to your HFR dashboard, go to “Forex Accounts”, and submit your FBS trading account number.

5. Does FBS charge deposit or withdrawal fees?

FBS does not charge internal fees on deposits or withdrawals. However, banks, card issuers, or e-wallets may apply small processing costs.

6. Can I receive bonuses and rebates together?

Yes, in most regions, bonuses and rebates can be used together. Always check the rules on your local FBS Promotions page and in the HighFxRebates Forex Bonuses section before activating a promo.

7. How often are FBS rebates paid?

HighFxRebates pays FBS rebates weekly. Cashback is credited automatically once your trades are confirmed by the broker.

8. Which trading platforms can I use with FBS?

FBS supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the FBS Trader App for mobile trading, on both live and demo accounts.

9. Is FBS good for beginners?

Yes. The Cent account, free Demo account, and strong educational resources such as FBS Academy and the Trader’s Blog make FBS very beginner-friendly.