Table of Contents

[ Show/Hide ]- • LiteFinance Overview

- • Key Features of LiteFinance

- • Exclusive Cashback Rebates with HighFxRebates

- • LiteFinance Pros and Cons

- • Is LiteFinance the Right Broker for You?

- • Is LiteFinance Regulated and Safe?

- • LiteFinance Account Types

- • Trading Instruments at LiteFinance

- • LiteFinance Fee Structure

- • LiteFinance Trading Platforms

- • Unique Features of LiteFinance

- • LiteFinance Deposits and Withdrawals

- • LiteFinance Bonuses and Promotions

- • LiteFinance Customer Support Review

- • Why Choose HighFxRebates for LiteFinance?

- • Final Words

- • FAQs: LiteFinance & HighFxRebates

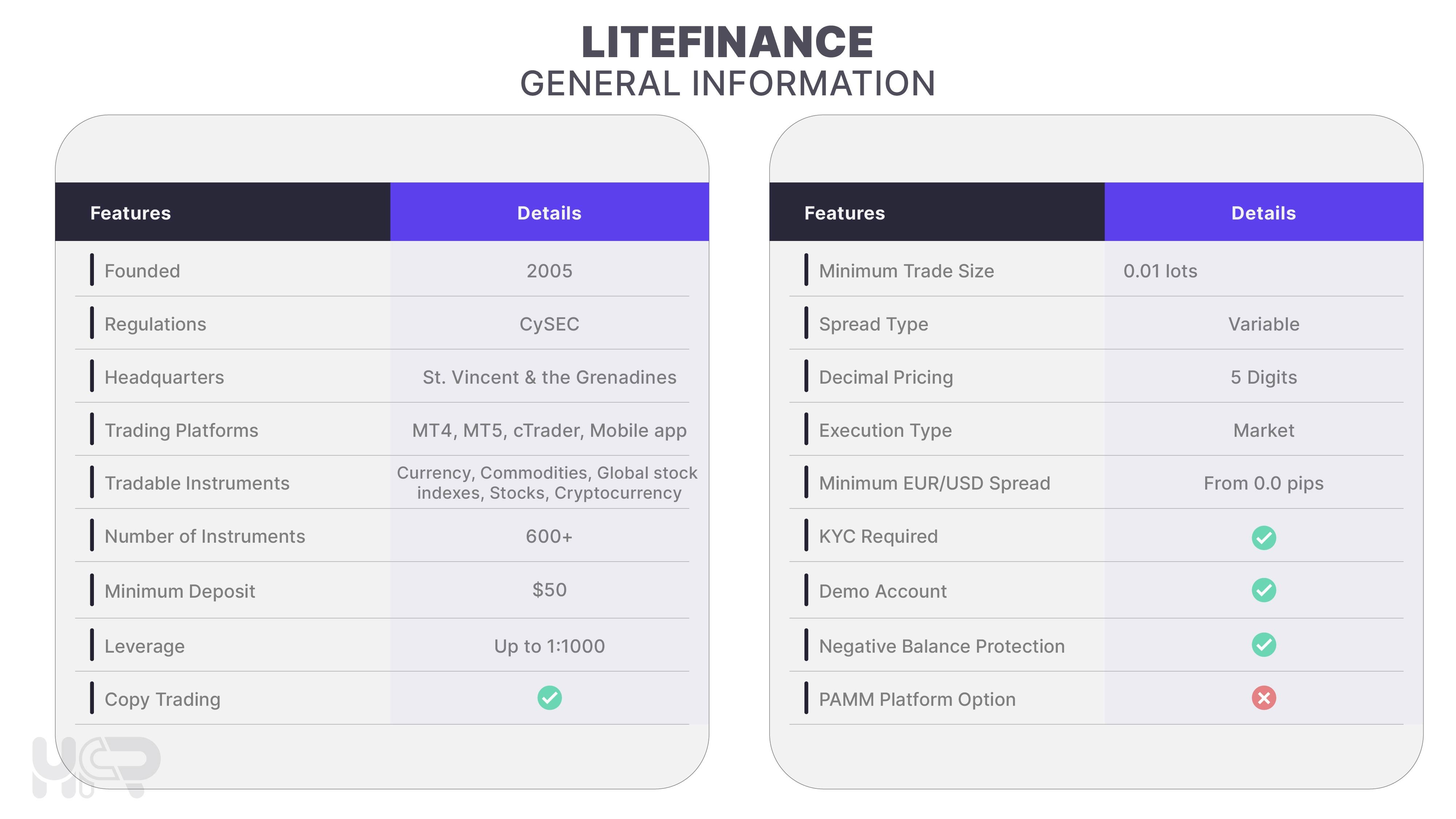

LiteFinance formerly known as LiteForex, is a globally recognized forex and CFD broker serving traders since 2005. Known for its advanced trading technology, diverse asset offerings, and competitive pricing, LiteFinance has positioned itself as a trusted choice for both beginners and experienced traders. In this detailed LiteFinance review, we explore the broker’s features, account types, trading conditions, and how you can maximize your profitability with LiteFinance Rebates offered by HighFxRebates.

LiteFinance Overview

Founded in 2005 and headquartered in St. Vincent and the Grenadines, LiteFinance has gained a global reputation through open pricing and simplified trading platforms. The broker offers several financial products like forex, commodities, indexes, shares, and cryptocurrencies. Trading can be easily conducted through various devices using the availability of MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Key Features of LiteFinance

- Advanced Trading Platforms

LiteFinance supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most powerful and widely used trading platforms. Forex Trading Platforms MT4 and MT5 offer customizable charts, technical indicators, and automated trading with Expert Advisors (EAs), making them ideal for traders of all experience levels. Additionally, LiteFinance has a user-friendly mobile app and cTrader platform for seamless trading on the go.

- A Variety of Account Types for Every Trader

LiteFinance understands that every trader is unique, which is why they provide a range of account types tailored to your needs. Whether you’re just starting out or you’re a seasoned pro, you’ll find the perfect fit with their ECN and Classic accounts. Each option comes with its own pricing structure, designed to match different trading styles. With a low minimum deposit, even beginners can jump in easily, while experienced traders will appreciate their competitive spreads and robust liquidity.

- Competitive Trading Conditions

LiteFinance is known as one of the best ECN brokers with low spreads, ultra-fast order execution, and minimal commission fees. For those interested in passive income, LiteFinance provides a copy trading system, allowing traders to follow and copy the strategies of experienced professionals automatically. This is a great option for beginners who want to trade like pros without extensive market knowledge.

Compare LiteFinance vs JustMarkets to find out which platform suits your trading style best.

Exclusive Cashback Rebates with HighFxRebates

Open a LiteFinance account through HighFxRebates to earn cashback rebates on every trade. This means you save on spreads and commissions while maximizing your profits, making your trading even more cost-effective!

LiteFinance Pros and Cons

When assessing LiteFinance as a broker, it’s crucial to consider both its strengths and potential limitations to determine if it aligns with your trading needs. Below is a comprehensive breakdown of the pros and cons of trading with LiteFinance.

Pros of LiteFinance

1. Globally Trusted Broker with Strong Regulation: LiteFinance is a reputable broker that has been operating since 2005. It is regulated by top authorities like the Cyprus Securities and Exchange Commission (CySEC) and follows the Markets in Financial Instruments Directive II (MiFID II) to strict financial security measures to protect traders’ funds.

2. Competitive Trading Conditions: LiteFinance vs. Other Brokers provides tight spreads from 0.0 pips (Excellent for scalpers and day traders), leverage up to 1:1000 for offering greater flexibility in managing risk and capital efficiency, and fast execution speeds below 100 milliseconds for ensuring minimal slippage and accurate order placement, even during volatile market conditions.

3. Swap-Free (Islamic) Accounts Available: LiteFinance offers the option to open swap-free Islamic accounts where the positions are left overnight free of interest. This benefits the long-term investors as well as the individuals following the principles of Islamic finance.

4. Built-In Copy Trading System: LiteFinance provides a new Forex Copy Trading Platform where new users are able to copy professional traders' transactions automatically. Unlike many brokers, LiteFinance does not charge additional fees for copy trading, making it cost-effective for new traders.

Cons of LiteFinance

1. Limited Regulatory Protection Compared to Some Competitors: While LiteFinance is a well-established broker, it lacks the approval of the best finance regulators like FCA. However, it has strong in-house security to protect customers' finances.

2. No Futures Trading: LiteFinance does not offer futures trading, which can be a drawback to investors interested in trading futures on commodities or indexes.

How to Maximize the Pros and Minimize the Cons?

Although there are some limitations to LiteFinance, the strengths can be used to the maximum to ensure profitability. With registration through HighFxRebates, HighFxRebates Cashback rebates are obtained on each trade that lowers trading costs incurred on spreads and commissions considerably. This makes sure that maximum benefit is obtained from the competitive trading terms provided by LiteFinance. Learn how to maximize profits with LiteFinance cashback offers through HighFxRebates.

Is LiteFinance the Right Broker for You?

Choosing the best broker depends on your trading style and goals. Below is how LiteFinance caters to different trader types:

- Casual Traders – Excellent Option

If you are a beginner or trade occasionally, LiteFinance is a great choice. Its easy-to-use MetaTrader platform, commission-free Classic accounts, and helpful educational resources make trading straightforward. Although casual traders might not use advanced features like ECN spreads or automated trading, the platform still offers a smooth and cost-effective experience.

- Social and Copy Trading – Excellent Option

For those who prefer learning from others or have limited time, LiteFinance’s social trading platform is ideal. It allows you to follow and copy the strategies of successful traders, with clear performance metrics to help you choose wisely. Just remember to review the traders you follow carefully to manage risk.

- Day Trading – Great Option

Day traders need tight spreads, fast execution, and high leverage, all of which LiteFinance delivers: Leverage up to 1:1000, allowing greater market exposure with a smaller investment. Over 600+ tradable instruments, including forex, stocks, commodities, and cryptocurrencies. One-click trading and real-time charting on MT4 and MT5 for rapid execution.

- News Trading – Good Option

If you like to trade based on news events, LiteFinance can work well for you. With direct market access through ECN accounts and rapid execution speeds, you can capitalize on market movements during major news releases. However, be aware that high volatility might lead to slippage. Best for traders who capitalize on market-moving events.

- Swing Trading – Suitable Option

Swing traders can benefit from LiteFinance’s broad range of instruments, allowing you to hold positions across multiple markets for longer periods. Flexible leverage and comprehensive analysis tools support longer-term strategies, though overnight swap fees should be considered unless you opt for a Swap-Free Islamic account.

- Scalping – Strong Option

LiteFinance meets needs with tight spreads, lightning-fast execution, and high-frequency trading support making it one of the best forex brokers for scalping.

- Fast execution speeds under 100 milliseconds, reducing slippage.

- Tight raw spreads from 0.0 pips, perfect for high-frequency trades.

- No trading restrictions, meaning scalpers can execute as many trades as needed.

- Automated Trading – Suitable Option

LiteFinance is compatible with automated trading strategies, thanks to its support for Expert Advisors (EAs) on MetaTrader platforms. If you plan to use algorithmic trading, consider that a solid understanding of EAs and a proper setup, possibly with VPS hosting, are essential.

Pro Tip: LiteFinance is a top-tier broker for traders of all levels, offering competitive spreads, fast execution, and innovative tools. However, trading costs can still add up. That’s why signing up through HighFxRebates is the best move—you’ll earn cashback on every trade, reduce expenses, and boost profits effortlessly. Join Now for the Highest Rebates on Every Trade!

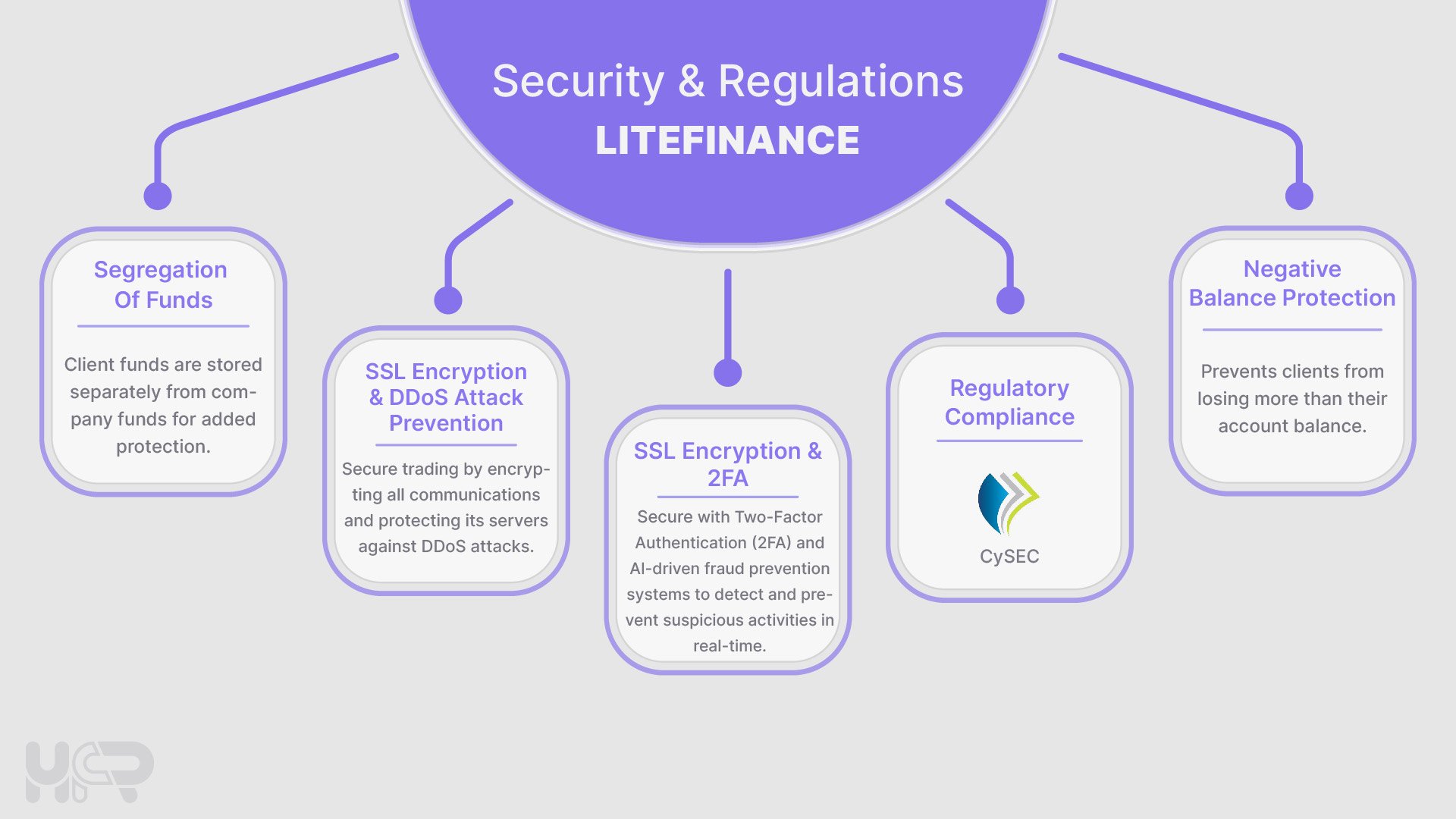

Is LiteFinance Regulated and Safe?

LiteFinance makes trust, security, and transparency at the core of its operations, ensuring a safe trading environment for its global clients. With regulatory compliance, secure fund management, and advanced technological protection, traders are free to implement strategies without security concerns.

1. LiteFinance Regulatory Compliance

LiteFinance operates under the authority of the the Cyprus Securities and Exchange Commission (CySEC). Even though LiteFinance lacks a number of strong regulators like some competitors, it compensates with robust internal controls, ensuring a secure trading environment for global clients.

2. LiteFinance Client Fund Protection

To safeguard traders' funds and enhance financial security, LiteFinance implements the following measures:

- Segregated Client Accounts – Each customer's account balance is held in separate bank accounts that are not touched by the operational expenses of the broker.

- Negative Balance Protection – Traders are protected from losses exceeding the account balance, even during highly unpredictable market behavior.

- Withdrawal Security – LiteFinance has strong KYC and anti-fraud protection to ensure withdrawals are done only through authenticated users, adding an extra layer of protection to finances.

- Partnerships with Tier-1 Banks – LiteFinance cooperates with the top banks to guarantee secure deposits and withdrawals to avoid counterparty risks.

3. LiteFinance Advanced Technological Security

LiteFinance employs cutting-edge security technology to ensure data protection and uninterrupted trading:

- SSL Encryption – All communications between traders and LiteFinance’s platforms are fully encrypted, ensuring data confidentiality and preventing unauthorized access.

- DDoS Attack Prevention – LiteFinance’s servers are protected against Distributed Denial-of-Service (DDoS) attacks, ensuring uninterrupted trading, even during peak volatility.

- Two-Factor Authentication (2FA) – Traders can enable 2FA to add an extra layer of security to their accounts, preventing unauthorized logins.

- Fraud Prevention Systems – LiteFinance uses semi-automated monitoring tools and AI-driven verification systems to detect and prevent suspicious activities in real-time.

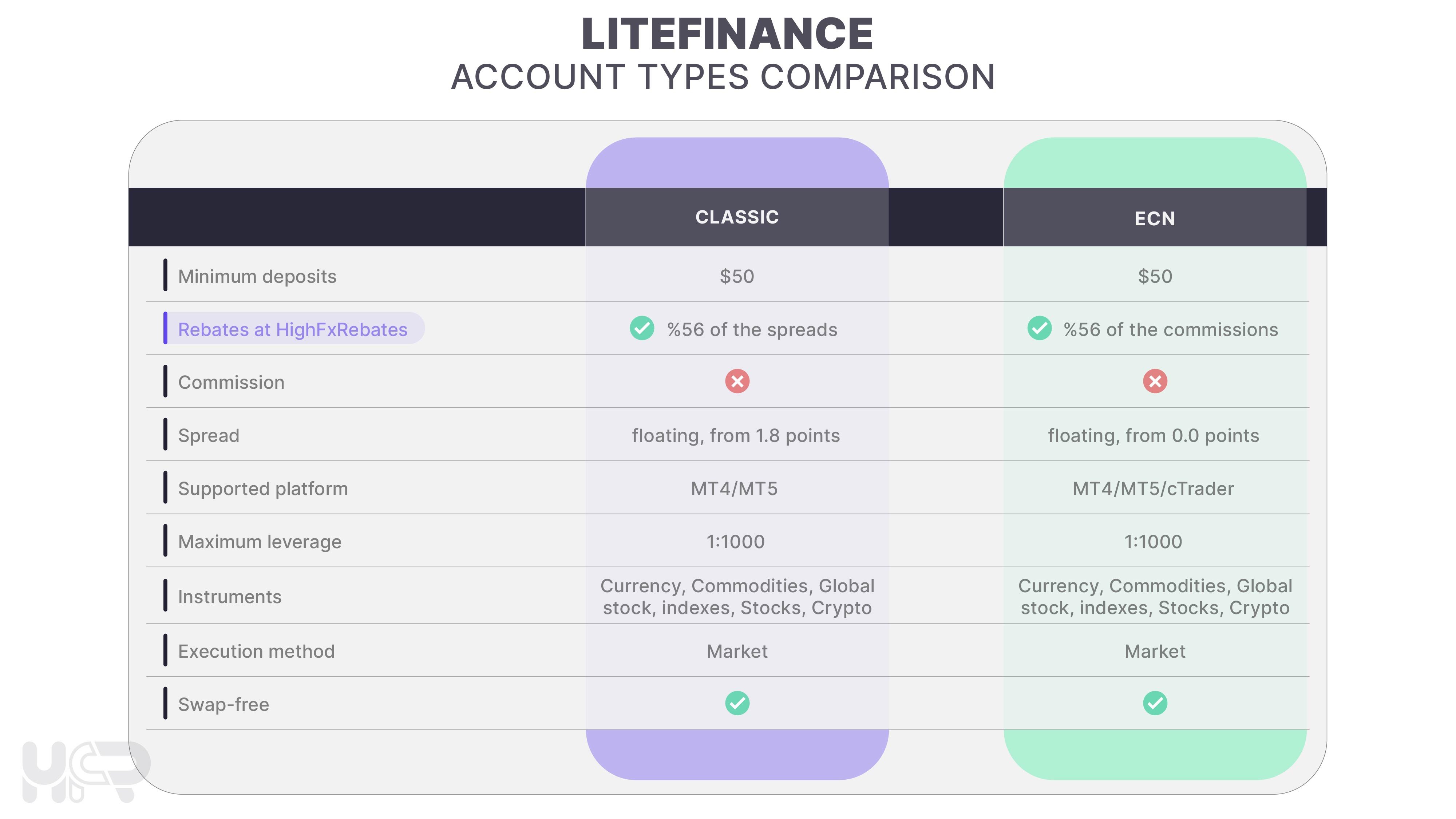

LiteFinance Account Types

LiteFinance offers two basic account types: ECN and Classic, both created to cater to the various purposes of trading and expertise. The two account types are served through MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, and mobile versions with a maximum leverage ratio of 1:1000. Swap-Free (Islamic) and Demo accounts are also provided by LiteFinance to cater to the specific traders. Explore the benefits of various LiteFinance account types, such as ECN, Classic, and Swap-Free accounts.

1. ECN Account – The best option for Scalpers & Professionals: The ECN account supports traders seeking raw spreads, fast execution, and market access. The account is ideal for scalpers, day traders, and users of automated trading. Check LiteFinance ECN Rebates.

- Spreads: From 0.0 pips (floating)

- Commission: $5 per round turn lot.

- Ideal usage: Scalpers, frequency traders, and professionals seeking low trading fees and precision.

2. Classic Account – Best for Beginners: The Classic account offers a spread-based commission-free trading experience that makes it a No Commission Forex Broker and a Best Beginner Forex Broker that prefers to have a low-cost structure. Check LiteFinance Classic Rebates.

- Spreads: From 1.8 pips (floating)

- Commission: None.

- Best for: Beginners and investors who like to use a traditional spread-based system that does not charge commission.

3. Swap-Free Islamic Accounts – Interest-Free Trading: LiteFinance provides Swap-Free Islamic accounts for traders following the guidelines of Islamic finance. The Swap-Free Islamic accounts are charge-free from the overnight swap fee and are both supported for Classic and ECN accounts.

- Swap Fees: None.

- Spreads: The same as the standard account type (ECN or Classic).

- Best used by: Traders compliant to the Sharia law that calls for an interest-free trading system.

4. Demo Account – No-Risk Trading: The Demo Account provides an ideal learning environment where beginners can train to trade using virtual money. The account mimics real market conditions. It can also be used by experienced traders to test new strategies.

- Virtual Money: Provided free.

- Access: All trading platforms (WebTrader, MT4, MT5).

- No time restrictions: Traders are free to train for an unlimited time.

- Best suited for: Beginners learning to trade the foreign exchange market and professional traders back-testing strategies.

Pro Tip: Which account from LiteFinance will suit your purposes?

- Beginners: Start with the Classic Account to have an easy, free-of-cost experience.

- Professionals & Scalpers: Choose the ECN Account that provides raw spreads and low commissions.

- Islamic Traders: Use Swap-Free Accounts to avoid paying overnight interest.

- Traders Who Would like to Practice: Try strategies free of charge using the Demo Account.

Trading Instruments at LiteFinance

LiteFinance offers an extensive range of trading tools that allow investors to diversify portfolios using a range of global markets. With the option to trade forex, commodities, indexes, shares, and cryptocurrencies, investors are given a large selection to take advantage of various trading strategies, be it scalping or long-term investment.

- Forex – Over 50 currency pairs that include majors, minors, and exotics.

- Commodities – Gold, silver, oil, and agricultural produce.

- Indices – Trade big global indexes like the S&P 500, NASDAQ, and FTSE 100.

- Stocks – US shares like Apple, Tesla, and Microsoft, as well as European shares.

- Cryptocurrencies – Such as Bitcoin, Ethereum, Ripple, etc.

Discover the diverse range of LiteFinance trading instruments available.

LiteFinance Fee Structure

LiteFinance provides a low-cost trading experience via low spreads, fair pricing, and no hidden fees. Traders are provided low-fee structures on all account types to promote an efficient trading environment.

- Minimum Deposit: Starts at $50 for Classic and ECN accounts.

- Raw Spread (ECN) Account Commission: $5 per lot (round turn) for ultra-tight spreads starting at 0.0 pips.

- Classic accounts: No commission, only spreads apply.

- Inactivity Fee: No inactivity fees, allowing traders to return anytime without penalties.

- Deposit & Withdrawal Fees: No fees on most transactions but third-party payment providers may charge processing fees.

- Swap-Free Overnight Charges: No swap fees on Islamic (swap-free) accounts.

- No fee for converting currency if trading within the account's base currency.

Pro tip: LiteFinance already provides low fees in the industry, but you can reduce costs even further by signing up through HighFxRebates. Check the Top LiteFinance Cashback.

LiteFinance Trading Platforms

LiteFinance offers a range of strong and flexible trading platforms to match every trading style, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, WebTerminal, and mobile trading applications for both iPhone and Android. The platforms are both beginner-friendly and professional-standard, equipped with advanced charting facilities, automated trading capability, and quick execution. Check the full details of LiteFinance Trading Platforms.

- MetaTrader 4 (MT4): Most appropriate for automated trading via Expert Advisors (EAs) and advanced charting.

- MetaTrader 5 (MT5): More timeframes, new features, and an inbuilt economic calendar.

- cTrader: Designed exclusively for ECN trading with fast execution and advanced order types.

- Web Terminal: No download necessary, web terminal that can be accessed anywhere.

- Mobile Apps: Make transactions anywhere through the entire array of functions, real-time data, and advanced tools.

Unique Features of LiteFinance

LiteFinance differs through innovative, trader-centered features that are designed to streamline the trading process to the best possible degree for every type of trader. An overview of LiteFinance antinational services and its unique features;

1. Ultra Low Spreads – As Low as 0.0 Pips

2. High Leverage – Up to 1:1000

3. Swap-Free (Islamic) Accounts

4. Built-In Copy Trading System

- LiteFinance uses a firm proprietary copy trading system wherein the transactions are copied automatically from the successful traders.

- No additional fee for copy trading—only standard trading fees.

- Flexible investment control—choose to track various traders or create personalized risk parameters.

- Best for beginners who want to trade with zero market knowledge.

5. Fast Order Execution & Efficient Withdrawals

- LiteFinance offers quick execution times and smooth withdrawal operations to ensure an efficient and safe trading process.

- Low requotes and slippage, even in volatile markets.

- Withdrawal requests are done within one business day but the whole time frame will be reliant upon the banks.

6. VPS Hosting – Uninterrupted Trading

LiteFinance offers VPS (Virtual Private Server) hosting to ensure uninterrupted and fast trading for its users, especially those who rely on Expert Advisors (EAs) and automated trading systems.

- 24/7 Uptime: Ensures continuous operation of Expert Advisors (EAs) and automated strategies.

- Low Latency: Facilitates faster order execution, crucial for scalpers and high-frequency traders.

- Microsoft Hyper-V Technology: Provides a stable and secure trading environment.

- Free VPS: Available for traders meeting specific deposit or trading volume requirements.

- Global Access: Trade seamlessly from any location without interruptions.

- Enhanced Security: Protects against power outages, system failures, and cyber threats.

Discover more details on LiteFinance VPS Services.

LiteFinance Deposits and Withdrawals

LiteFinance provides various safe and convenient deposit and withdrawal options to enable traders to manage their funds easily.

Deposit Options: LiteFinance offers several methods for depositing funds:

- Credit Cards: Visa, MasterCard, and UnionPay

- Bank Wire Transfers

- Electronic Transfers: Various e-wallet options like Skrill, Neteller, Perfect Money, and AdvCash.

- Cryptocurrencies: Popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and Tron (TRX).

- Local Payment Methods: For customers within specific regions, there are options like UZCARD/HUMO within Uzbekistan and Vodafone Pay within Egypt.

Processing Time: Most deposit options are instant.

Fees: No deposit fees are charged by LiteFinance, but third-party payment providers may charge additional.

Withdrawal Methods: Traders can withdraw funds using the same methods available for deposits: Traders can withdraw funds using the same methods available for deposits:

- Credit Cards

- Bank Wire Transfers

- Electronic Transfers

- Cryptocurrencies

Processing Time: Withdrawal requests are done within 24 hours. Automatic withdrawals are made to fully verified customers up to $5,000 a day, the majority being done within minutes making it Instant withdrawals forex broker.

Fees: Withdrawal does not incur a fee from LiteFinance but third-party fees are applicable depending on the method.

Withdrawals must be made using the same method and currency as the initial deposit, in compliance with Anti-Money Laundering (AML) policies. Check the full LiteFinance Deposit and Withdrawals options.

LiteFinance Bonuses and Promotions

LiteFinance offers a range of promotions and bonuses to enhance the trading experience.

20th Anniversary Challenge: In celebration of its 20th anniversary, LiteFinance is hosting a trading contest throughout 2025, featuring a prize pool exceeding $1,000,000. Participants can earn points through trading activities, deposits, referrals, social media engagement, and using the LiteFinance mobile app, with opportunities to win weekly, monthly, and annual rewards. Check LiteFinance 20th Anniversary Challenge Bonus.

Trade Smart Challenge: This promotion encourages traders to use their skills and strategies for a chance to win attractive prizes. Details about the specific rewards and participation criteria are available on LiteFinance's official website. Check LiteFinance Trade Smart Challenge promotion.

These promotions and bonuses are designed to reward active traders and provide opportunities to maximize returns. Additionally, with HighFxRebates, traders can earn up to 56% LiteFinance cashback on spreads and commissions, further reducing trading costs and increasing profitability.

LiteFinance Customer Support Review

LiteFinance offers 24/7 multilingual support through live chat, email, phone, and messaging apps like Telegram and WhatsApp. The support team is well-trained to handle technical, trading, and account-related issues promptly. Traders can access assistance in multiple languages, ensuring a smooth experience for a global audience. Additionally, VIP account managers provide personalized support for high-volume traders.

Why Choose HighFxRebates for LiteFinance?

- Weekly Payments – Rebates are credited weekly to your HFR account.

- Lower Trading Costs – Save on spreads and commissions effortlessly.

- Cashback on Every Trade – Earn rebates whether your trades are profitable or not.

- Full Transparency – Simple, clear calculations with no hidden fees.

How to Earn Forex Cashback with HighFxRebates

HighFxRebates offers the best forex rebate program, helping traders cut costs and boost profitability when trading with LiteFinance.

- Register for LiteFinance – Open a LiteFinance account through our referral link. If you already have a LiteFinance account, email [email protected] to request a transfer under our partner code.

- Verify Your LiteFinance Account – Complete the KYC process.

- Login to your HighFxRebates account – If you don’t have an account, Register for the HighFxRebates platform.

- Add Your LiteFinance Account – Navigate to Forex accounts from the dashboard, and submit your details to your HighFxRebates account.

- Start Trading & Earn Rebates – Once confirmed, start trading and receive weekly rebates into your HighFxRebates account.

Final Words

In LiteFinance Review 2025, we’ve highlighted why LiteFinance stands out as a top-tier broker with tight spreads, swap-free accounts, copy trading, and high leverage. When paired with HighFxRebates, traders benefit from reduced costs and increased profitability. Whether you’re a beginner or an experienced trader, this combination offers a cost-efficient and rewarding trading experience.

Start trading with LiteFinance today through HighFxRebates to maximize your returns and enjoy the highest forex cashback in the industry!

FAQs: LiteFinance & HighFxRebates

- What is Forex cashback with HighFxRebates?

Forex Cashback is a system that rewards part of your trading fee (spreads & commissions) back to you on every trade—in both profitable and losing ones. With registration via HighFxRebates, you save a significant amount of trading fees. Read the Full What Are Forex Rebates article. - How does HighFxRebates work with LiteFinance?

HighFxRebates partners with LiteFinance to provide cashback rebates on every trade. Simply Sign up, add your LiteFinance account, and receive weekly cashback to your HFR account without affecting spreads or leverage. - Which LiteFinance accounts are eligible for cashback rebates?

Classic, ECN accounts qualify to earn cashback rebates. Demo accounts are not qualified because they are not funded with real money. Check The Highest LiteFinance Rebates in detail. - Does cashback apply to losing trades?

Yes, you earn cashback rebates on every trade regardless of the outcome. - When are the rebates payable in cash?

Each week, rebates are added to your HighFxRebates account to ensure an ongoing reduction in trading costs. Check LiteFinance Cashback and Payment Options. - Does HighFxRebates change my trading conditions?

No, registering through HighFxRebates does not affect your spreads, leverage, or execution speed. You trade under the same conditions as a standard LiteFinance account holder. - Is LiteFinance regulated and safe?

Yes. LiteFinance is regulated by CySEC. It offers segregated client accounts, supports SSL encryption, and has anti-fraud protection to ensure a secure trading environment. - Which trading instruments are supported by LiteFinance?

LiteFinance offers instruments, including Forex, Commodities, Indices, US and European shares, and Cryptocurrencies. Check LiteFinance Cashback on each instrument. - Is LiteFinance good for beginners?

Yes, LiteFinance is good for beginners due to its Low minimum deposit values ($50), Commission-free Classic accounts, Copy trading options, and educational materials and demo accounts. - How can I contact LiteFinance support?

LiteFinance offers 24/7 multilingual support via Live Chat, Email, Phone Support, WhatsApp, and Telegram. - Can I link an already-existing account of LiteFinance to HighFxRebates?

Yes, it is possible to add an already opened LiteFinance account to HighFxRebates by contacting the LiteFinance support team and requesting them to transfer your account under the partner code. Check the Existing Account for LiteFinance Rebate section to know how to link your account. - How to earn cashback rebates on LiteFinance?

Register an account with LiteFinance through HighFxRebates. Verify Your Account, then Log in to HighFxRebates and add your LiteFinance account to your HighFxRebates account. Once your account is confirmed, start trading to get cashback on every trade. - Are there usage fees for HighFxRebates?

No, HighFxRebates does not charge anything. There are no extra fees or charges. - What leverage does LiteFinance offer?

LiteFinance offers a leverage of 1:1000. - Does LiteFinance offer swap-free (Islamic) accounts?

Yes. LiteFinance offers swap-free trading accounts.